Recent News

April 23, 2020

Published by Imran Malik at April 23, 2020

Categories

As the number of COVID-19 deaths in Florida approaches 1,000, many of us are wondering if it’s time to invest in a life insurance policy or increase our benefit, if we already have a policy. The decision is, of course, up to each individual, but there are several factors you should consider before deciding on a policy at this time. In this blog post, I’m going to discuss things to consider if you presently have life insurance, as well as problems you might encounter in trying to change your policy, get a new policy, or file a life insurance claim. […]

April 21, 2020

Published by Imran Malik at April 21, 2020

Categories

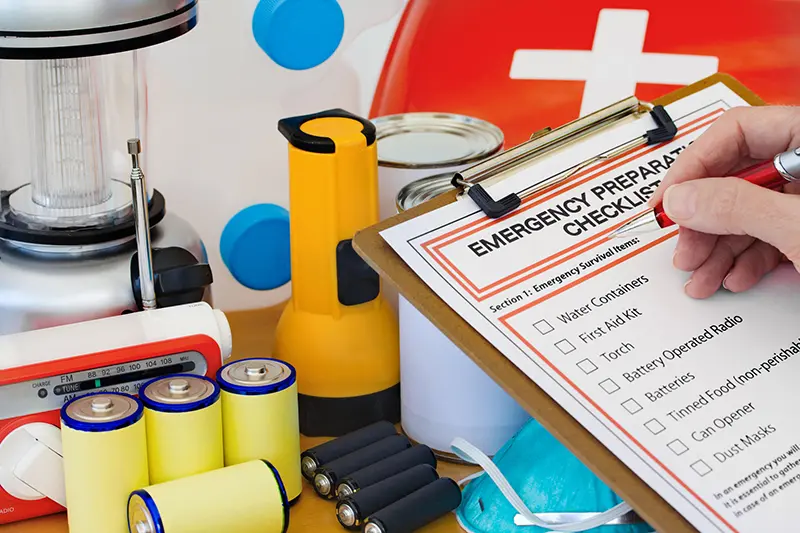

With the latest projections showing Florida experiencing 149 deaths per day at the peak of the coronavirus pandemic, it’s difficult to think about hurricanes, but indeed, summer is approaching and forecasters are predicting a very active Atlantic hurricane season. According to researchers at the Colorado State University, we may see 16 named storms this year, including eight hurricanes, and four of those hurricanes are predicted to be category 3, 4 or 5 storms. With water temperatures in the Gulf of Mexico more than three degrees above average, we know to expect bigger, more destructive hurricanes in Florida this year. And […]

March 23, 2020

Published by Imran Malik at March 23, 2020

Categories

If your Florida business has been forced to close due to the outbreak of COVID-19, you might be thinking about turning to your commercial property insurance to help you cover your losses. After all, the reason you have insurance is to pay for losses due to unforeseen threats to your business’s survival. However, insurance matters are rarely straightforward, and this is no exception. In this blog post, I’m going to discuss business interruption coverage and whether or not it applies to interruptions due to COVID-19. First we’ll look at what business interruption coverage typically covers, and then we’ll examine ambiguities […]

February 13, 2020

Published by Imran Malik at February 13, 2020

Categories

Strong winds and flying debris during storms can damage your home’s roof in different ways. Shingles can be blown off or damaged, leaks can occur, gutters can be damaged, and the interior of your home can be exposed to the elements. Roofs can also be damaged by falling tree limbs and hail. Regardless of how and where the damage occurs, it is very important to get it repaired as soon as possible to avoid further damage to your home. When their roofs are damaged, most homeowners contact their insurance companies, expecting that their policies cover repair or replacement costs. Their […]

January 30, 2020

Published by Imran Malik at January 30, 2020

Categories

If you have lived in Florida for any length of time, you have likely experienced more than one serious storm. As beautiful as the weather is most of the time, it can become violent and destructive when a tropical storm or a full-blown hurricane passes over the area. When that happens, your home is extremely vulnerable to damage. One of the most vulnerable parts of your home is your roof. Shingles can be blown off; trees or blown debris can crash through your roof; and the interior of your home can be exposed. To make your home safe and prevent […]

January 6, 2020

Published by Imran Malik at January 6, 2020

Categories

While the number of fatalities from car and truck accidents across the U.S. has decreased in recent years, Florida still ranks very high in fatalities and injuries. In fact, in 2018 in Florida, there were 3,174 fatalities and 254,873 injuries from motor vehicle crashes, and in Orange County alone, 22,866 people were injured in car accidents The holiday season is especially dangerous for Orlando drivers, but with 70 million tourists visiting our city each year (and many of them renting cars to travel to and from our theme parks and other attractions), any time of year can be perilous. That’s […]

December 13, 2019

Published by Imran Malik at December 13, 2019

Categories

As 2019 draws to a close, many of us review the year’s events, as well as our personal accomplishments, things we still want or need to do before 2020, and the things we just won’t get to this year but plan on getting to next year. However, before we close out this year and make resolutions for the new year, I want to suggest adding a review of your Florida homeowner’s insurance policy to your year-end check list. I know reviewing your homeowner’s policy isn’t exciting, but as an attorney who handles a multitude of insurance claim cases, I […]

November 22, 2019

Published by Imran Malik at November 22, 2019

Categories

As a Florida insurance claim attorney, I often hear clients complain about their insurance companies and the way their property damage claims are handled. An area of special concern, especially following storm damage, is the amount their insurance companies are willing to pay for covered damage to their homes and personal property. Some of this legitimate concern is due to the homeowners’ lack of knowledge about their policies. For the most part, however, the homeowners are not to blame; their policies are abstruse and, in many instances, deliberately ambiguous. In this blog post, I’m going to try to demystify two […]

November 7, 2019

Published by Imran Malik at November 7, 2019

Categories

In October, 2018, Hurricane Michael devastated much of the Florida Panhandle region. The Category 5 storm caused 43 deaths and widespread catastrophic damage to residential and commercial properties. Undoubtedly, Michael is still fresh in our memories a year later as the 2019 Hurricane Season draws to a close. Unfortunately, Floridians who live and work in the areas hardest hit by Michael are reminded daily of the storm’s devastation, since their insurance companies have not yet paid their property damage claims and they are still struggling to recover. In fact, according to data on filings received by the Florida Office of […]

October 23, 2019

Published by Imran Malik at October 23, 2019

Categories

In my years of experience as an insurance claim attorney, I’ve often heard clients complain about their Florida homeowners insurance companies. Many of them have complaints about legitimate claims that were denied or underpaid. Others have complaints about the long, complicated process involved in filing a claim. Still others complain about the policies themselves and how difficult it is to understand them. In this blog post I’m going to explain some of these difficulties, the thorny elements of policies such as limitations, exclusions, replacement cost versus actual cost, and assignment of benefits. These are all parts of insurance policies that […]